Asset management

Quantitative investment strategies

Our approach to capital management

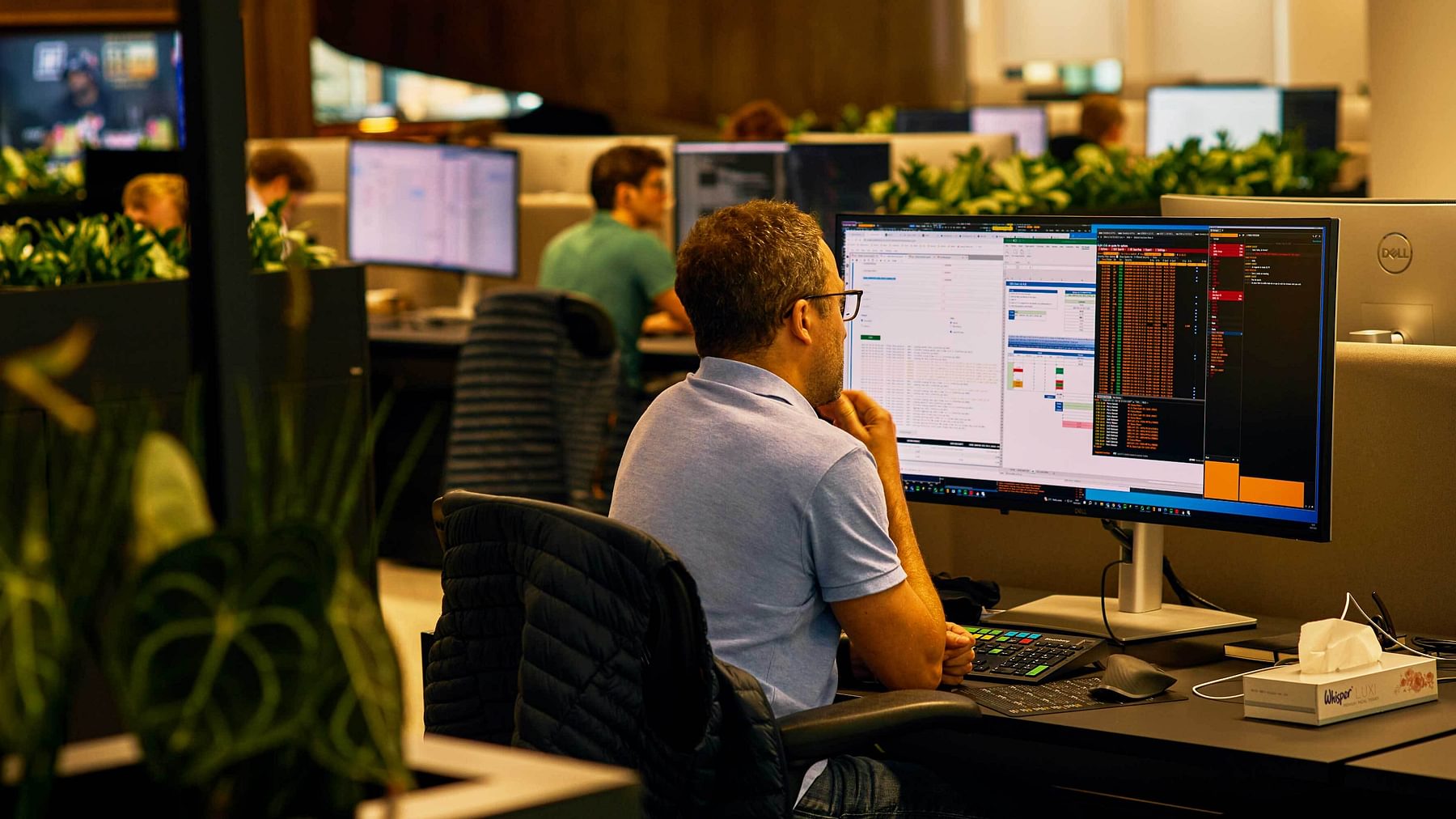

High-performance culture

Our culture is characterised by collaboration, intellectual integrity, and methodological rigour. We employ investment professionals who combine exceptional technical skills with in-depth market expertise and a desire to collaborate.

Disciplined strategy; sustainable performance

Our strategies span trading frequencies and styles and are implemented across multiple industries and instruments. Every approach reflects our commitment to rigorous research, prudent risk management, and a focus on delivering durable, long-term returns.

Established investment platform

Scalable and containerised processes across data, execution and operations ensure the seamless functioning of our strategies. Centralising and sharing these functions across our investment team improves efficiency, reduces transaction costs, and accelerates the journey from idea generation to execution. We want to empower our researchers and managers as much as possible so that their strategies can thrive.

15

100%

4

1/3

70+

Risk matters

Risk management has underpinned our long-term success. The careful consideration of risk informs everything we do at Cap, from the design of our investment strategies and the size of our positions, to the counterparties we onboard and the processes that drive our business.

Systematic alternatives

Our programmes include our flagship multi-strategy capital management system. These programmes are offered to our clients in a range of onshore, offshore and single-investor formats. For institutional investors, our scalable investment platform allows us to construct solutions tailored to specific requirements.